Now Reading: BREAKING: Australian Drivers To Receive Share Of £63m In Compensation – Here’s What It Means For YOU

-

01

BREAKING: Australian Drivers To Receive Share Of £63m In Compensation – Here’s What It Means For YOU

BREAKING: Australian Drivers To Receive Share Of £63m In Compensation – Here’s What It Means For YOU

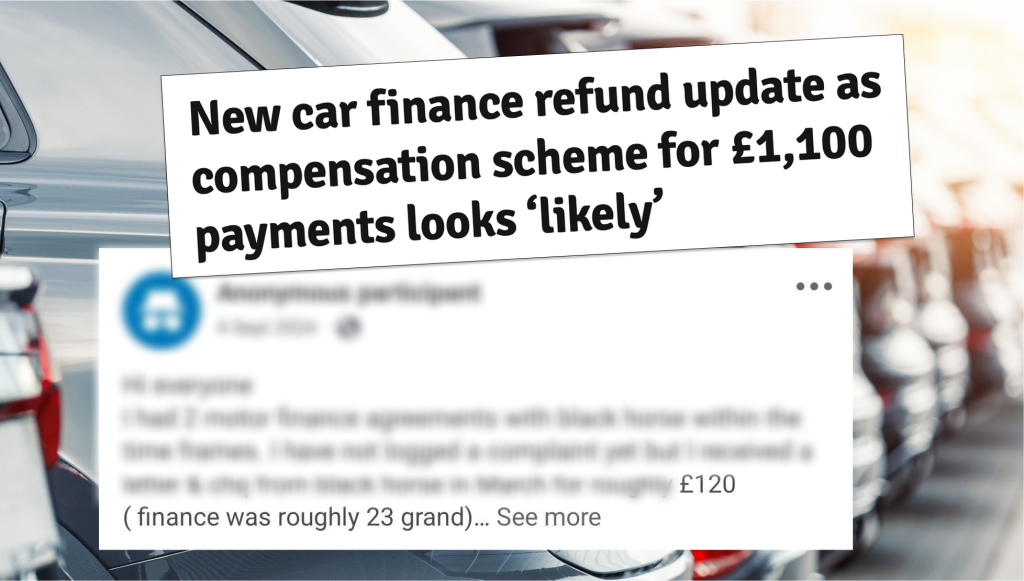

Breaking news out of Australia could have massive ramifications for UK drivers as the battle for car finance compensation rages on.

Car finance lender Westpac has reached an A$130 million (£63.47 million) settlement on a class action lawsuit against the lender over commissions paid to auto dealers over five years, the bank said this past Friday.

In a class action lawsuit filed by firm Maurice Blackburn, it was claimed that Westpac and St George Finance let car dealers hike interest rates on car loans to earn these commissions between March 1, 2013 and October 31, 2018.

And this is not even the most recent instance of a finance lender being forced to payout Down Under: the provider ANZ paid out A$85 million last October to settle a 2020 class action over car loans issued under its credit license between 2011 and 2016, once more stemming from these ‘flex commissions’ which are eerily similar to the hidden commissions involved in UK car finance contracts.

So what might this mean for resolving the scandal in the UK?

Whilst it’s too soon to accurately say how this might impact the upcoming Supreme Court decision, it’s looking positive for UK drivers who did overpay for their finance deals.

April’s crunch court battle will see notorious lenders Close Brothers and FirstRand appeal against an earlier ruling that they knowingly mis-sold customers their car finance deals and now owed compensation in isolated cases.

And if the recent Australian ruling is any inclination, the courts could very well side once again with the drivers who were mis-sold over the multi-million pound firms and lenders who were pocketing hundreds, even thousands of pounds extra from their customers.