Now Reading: BREAKING: Close Brothers Projects Losses of £103m In Wake of Car Finance Scandal

-

01

BREAKING: Close Brothers Projects Losses of £103m In Wake of Car Finance Scandal

BREAKING: Close Brothers Projects Losses of £103m In Wake of Car Finance Scandal

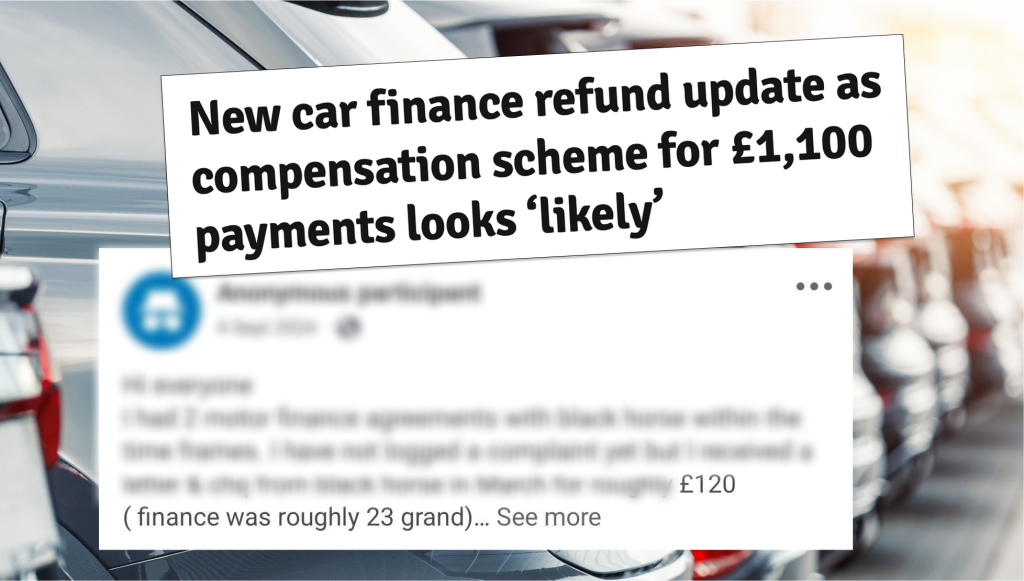

Breaking news reports say that the car finance lender Close Brothers have fallen to a £103 million first half loss after they faced increased scrutiny over motor finance commission scandal.

Alongside the likes of Lloyds/Black Horse (£1.2bn) Santander (£295m) and Barclays (£90m), who have each set aside millions of pounds in provisions for compensation, Close Brothers previously set aside a £165 million provision to cover possible legal and compensation costs over mis-sold motor finance.

This quote from The Times describes the tense situation that Close Brothers, alongside the aforementioned lenders and dozens of other notable names, face in the coming months as the scandal is set to escalate further.

“The merchant bank is at the centre of a looming crisis facing the motor finance industry, with major lenders in the sector potentially on the hook for large sums in compensation over motor finance deals with hidden commission payments.”

“The lender warned shareholders last month that it would make the provision following a “thorough assessment”, although it cautioned that there remains “significant uncertainty” over the outcome of an imminent court appeal and a review by the Financial Conduct Authority (FCA).”

The news comes a fortnight before the huge Supreme Court case over the car finance scandal, which looks to define whether or not lenders and brokers should have been more transparent about commissions on car loans.

In the aftermath of this, the FCA is due to announce by the end of May a potential redress scheme by those affected by the car finance scandal.