Now Reading: MAJOR £1.2 BILLION Driver Refund Could Be EVEN HIGHER As UK Bank ADMITS Uncertainty From Car Finance Scandal

-

01

MAJOR £1.2 BILLION Driver Refund Could Be EVEN HIGHER As UK Bank ADMITS Uncertainty From Car Finance Scandal

MAJOR £1.2 BILLION Driver Refund Could Be EVEN HIGHER As UK Bank ADMITS Uncertainty From Car Finance Scandal

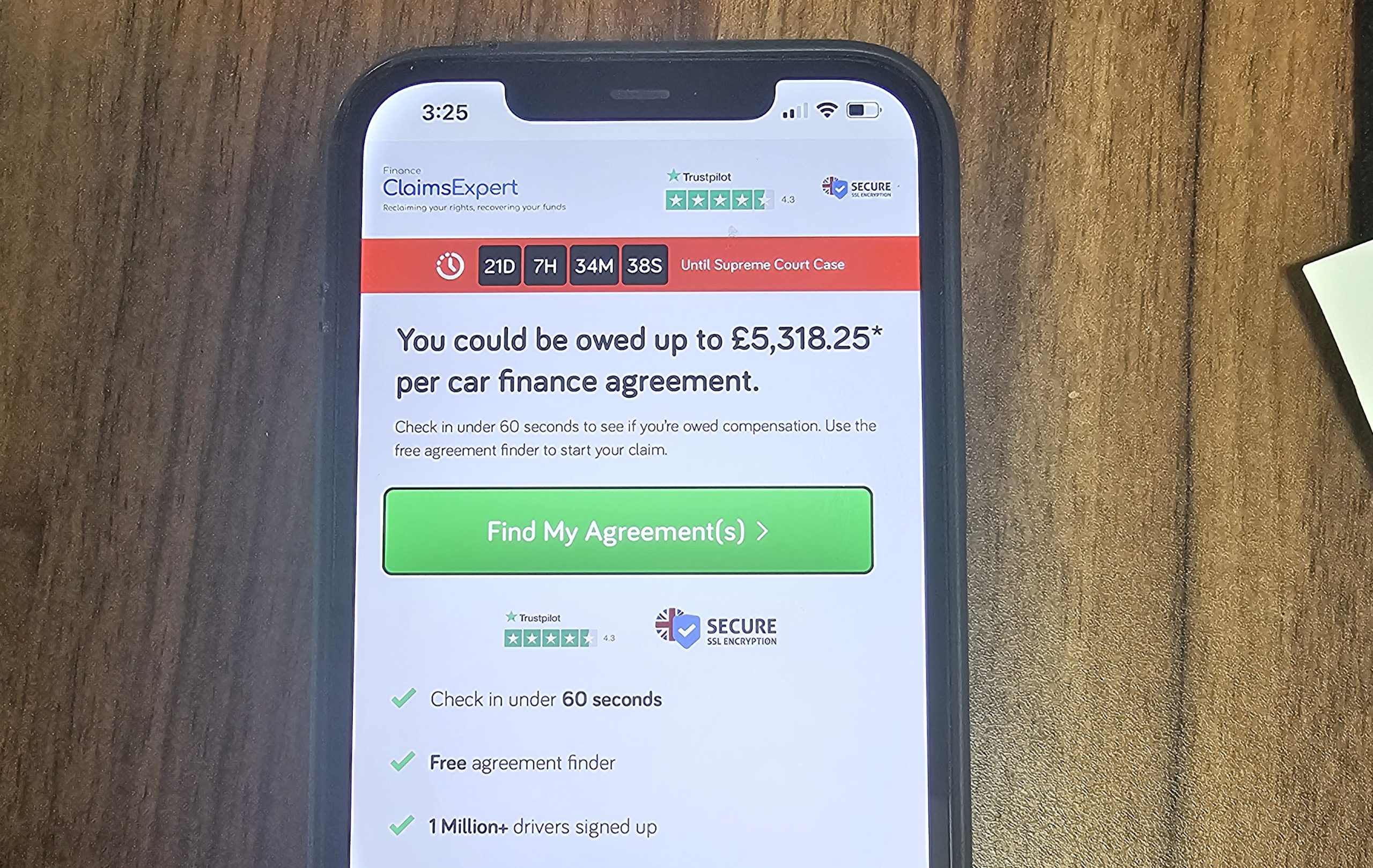

A Major UK bank has admitted that their £1.2billion driver refund package could differ significantly, Wheel Reporter has learned.

Over 30 banks and lenders could be in line to pay out an estimated £40 billion back to drivers across the country.

It comes on the back of the 2024 investigation by the Financial Conduct Authority (FCA) into car finance mis-selling practices, where it was found that some lenders increased interest rates on car financing deals to earn extra commission.

Drivers must have purchased cars, vans, or motorbikes on a finance deal such as hire purchase (HP) or personal contract purchase (PCP) between 2007 and 2021 to qualify for possible compensation.

It was reported that Lloyds Banking Group under their trading name of Black Horse Finance had set aside £450 million back in 2024 to cover car loan mis-selling.

That figure has now increased to £1.2billion in potential refunds to drivers in the UK, and Wheelreporter.com has learned that this figure could skyrocket.

A statement from Lloyds Banking Group PLC said: “There is a significant level of uncertainty in terms of the final outcome,” admitted the bank. “As a result, the final financial impact could differ materially to the amount provided.”

Pingback: UK Watchdog Announces National Compensation Scheme As 31m Drivers Could Benefit – Are You One? – Motorist Justice UK